Experts have called on the government to improve the legal regime to allow for more venture capital inflows into the Country. These say that the future of venture capital investments in Uganda is bright but requires legal backing. While the total of venture capital investments in Uganda hit US 11.3m dollars in 2020, the venture capital tech companies are currently operating under immense pressures accruing from the COVID 19.

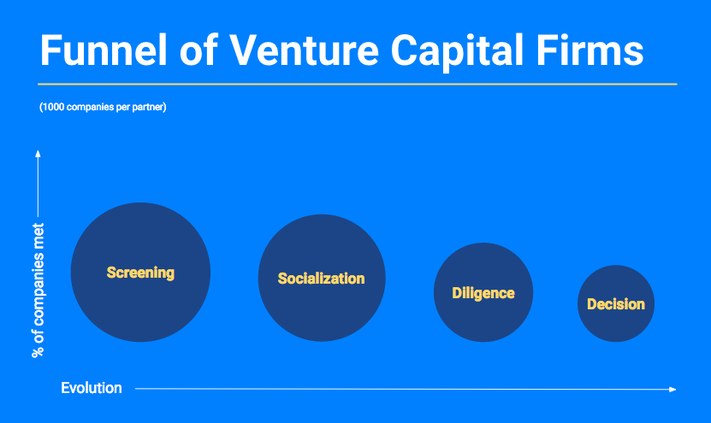

Startup companies with the potential to grow need a certain amount of investment. But wealth investors usually invest their capital in only businesses with a long-term growth perspective. This capital is known as venture capital and the investors are called venture capitalists.

The Partech Analysis report of 2020 indicates that out of the 1.4 billion dollars invested in Africa, only 11.3 million dollars were invested in Ugandan Tech Firms.

With the Covid 19 Pandemic compounding uncertainty, and the sales made by venture capital-funded businesses reducing, experts have called on the government to pass laws that favour the inflow of venture capital into Uganda as Loius Namwanja a commercial lawyer from a tech start-up explains.

Joseph Lutwama the director of programmes at Financial Sector Deepening Uganda, long term financing for startups that can enable the growth of businesses and the growth of the economy, in the long run, makes venture capital stand out from all other forms of equity financing.

Depending on the structural bottlenecks that have been worsened by Covid 19, Shadrack Kolya a financial Consultant advises the government to be forward thinking in terms of regulation.

It is however not clear, whether there are any financing options available for startups in case of a reduction of venture capital.

Experts have now called on the government to shield the economy.