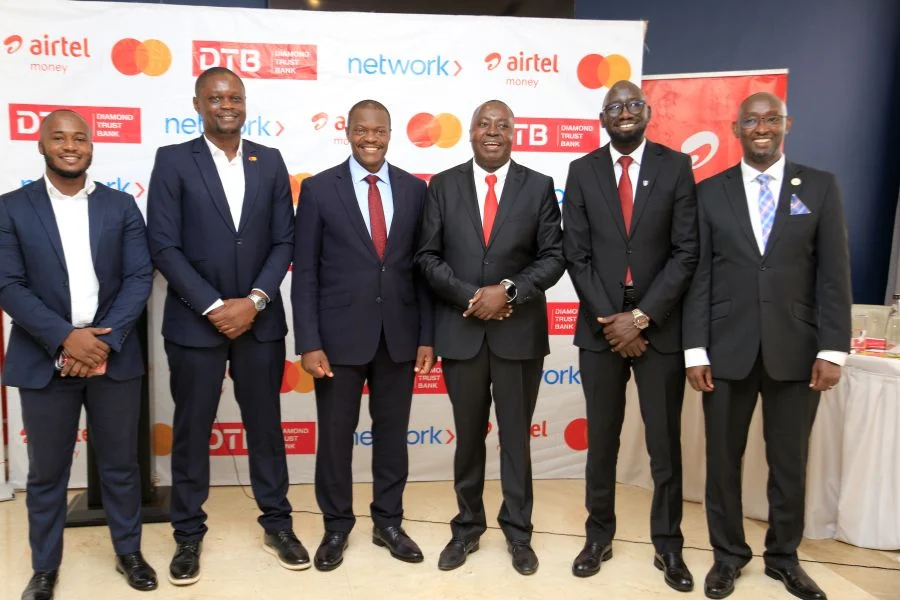

Airtel Money, in collaboration with Mastercard, has introduced a virtual card designed to empower Ugandan customers to conduct international transactions with ease. This innovative service allows users to utilize their Airtel Money accounts for purchases at over 100 million merchants across 200 countries within Mastercard’s extensive global network.

Japhet Aritho, Managing Director of Airtel Money Uganda, described the virtual card as a transformative tool for digital commerce. He emphasized that the card not only facilitates global purchases but also provides users with complete control over their transactions. Aritho stated, “It means someone with a mobile phone is now able to access anything they want to buy anywhere in the world.”

With a customer base exceeding 16 million, Airtel Money anticipates that this new offering will significantly enhance the digital transaction experience for its users. The virtual card is expected to leverage the increasing penetration of smartphones in Uganda, enabling more people to participate in global e-commerce.

Godfrey Ssebaana, CEO of Diamond Trust Bank (DTB), highlighted the importance of such partnerships in advancing financial inclusion. He noted that collaborating with telecom companies, which have extensive reach among the unbanked population, aligns with DTB’s mission to facilitate accessible financial services. Ssebaana expressed enthusiasm about the potential of the virtual card to simplify transactions for Ugandans.

Lenin Oyuga, Mastercard’s Head of Telco Commercial and Partnerships for the Middle East and Africa region, underscored the demand for convenient cross-border payment solutions. He remarked that with millions of active users engaging with mobile applications monthly, the Airtel Money virtual Mastercard meets a critical need for seamless international payments directly from mobile phones.

This initiative reflects Airtel Money’s commitment to providing innovative financial solutions that cater to the evolving needs of its customers, further integrating Uganda into the global digital economy.